Fortune India published an interesting story on the real estate investments sentiment in India.

Experts say that Indian money—a lot of it new age and retail—is deflecting from real estate, attracted more to asset-light tech businesses. This is a distinct divergence from the findings of the McKinsey report focused on our western counterparts.

Fortune India

Sanchit Gogia, the chief analyst, founder and CEO of Greyhound Research, says, “Indians are investing in so many things. Real estate is selling but in pockets. For instance Hyderabad (SEZ, commercial), or Gurugram (commercial) in certain sectors. But a lot of money is going in mutual funds, retail investing (and these are new age investors), angel investors.”

Sanchit further adds that a lot of the retail money is coming to the market because of tech and tech-backed businesses. See the complete Fortune India story.

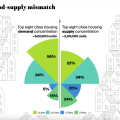

A lot of developments are shaping or reshaping the future of retail that we might soon see in 2022 itself—the shifting consumer sentiment, the retail design, omnichannel and technology in shopping, the retail business sustainability models, and so on. It shows in the real estate projects too, for strategy, design, marketing, and their growth goals.

The International Council of Shopping Centers (ICSC) published a report a few months ago, on the future of shopping centers. Retail is a key driver of the growth of real estate, and the investment portfolio of many companies might look a lot more integrated for retail and real estate, very soon.

No Comments

Leave a comment Cancel