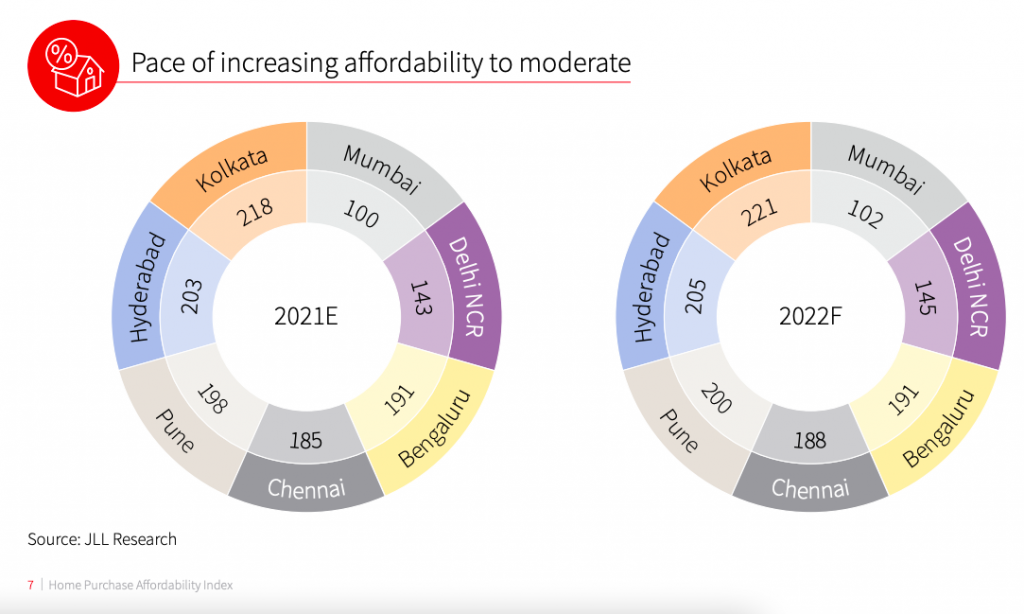

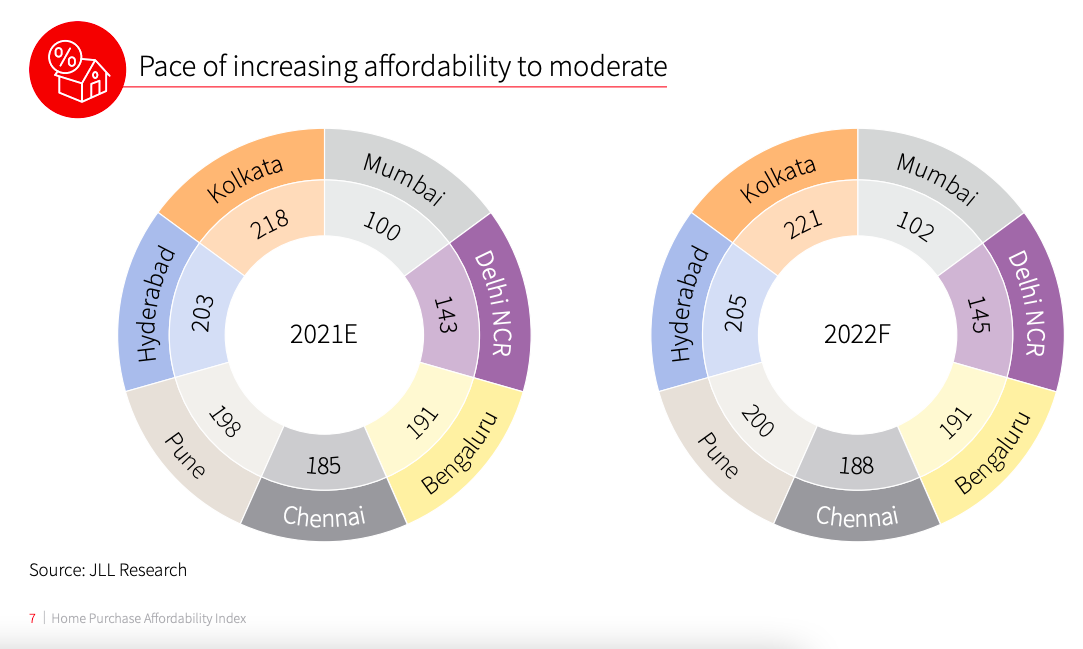

According to JLL’s Home Purchase Affordability Index 2021 report, the combination of three factors—household income, property prices, and home loan interest rates has made residential property most affordable since 2011. The Indian real estate is growing and is showing a promising sign in the last few months.

Download the Home Purchase Affordability Index 2021, by JLL.

JLL HPAI (Home Purchasing Affordability Index) is the ratio of the average household income to the eligible household income. The eligible household income is defined as the minimum income that a household should earn in order to qualify for a home loan on a 1,000 sq ft apartment at the prevailing market price.

People reacted to this story.

Show comments Hide comments[…] Home buying sentiment in India: JLL published Home Purchase Affordability Index […]