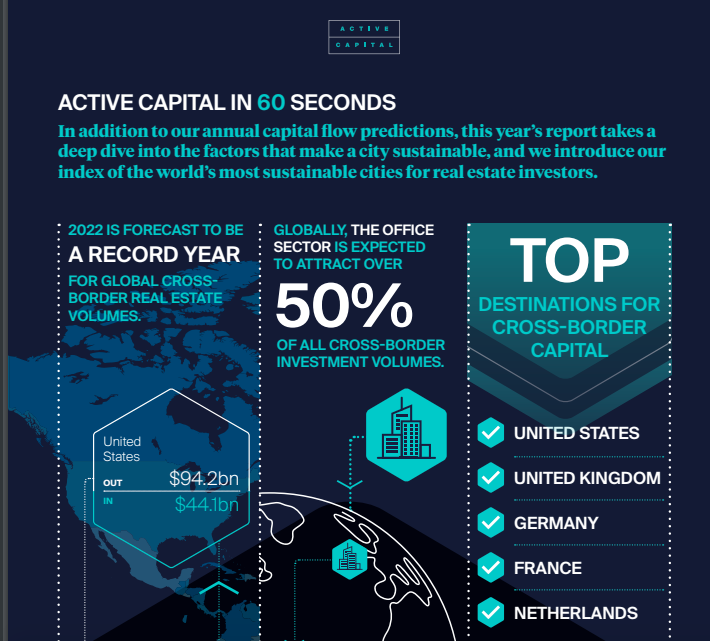

Every year, Knight Frank publishes an Active Capital Report that offers data-driven and insightful thoughts on the international real estate investments—for the capital flows trends, projections, and the factors that play a role in these trends.

See the Active Capital Report here.

The report says—”There are four parts to the methodology. Firstly, determining the appropriate cities to consider for real estate investors; secondly, undertaking an extensive meta-analysis where we reviewed a large number of city sustainability indices and real estate benchmarks; thirdly, sourcing and cleaning potentially relevant variables; and finally, running the econometric analysis to determine the most representative sustainably led cities score.”

Increasing international real estate footprints in India

More and more international real estate brands are entering or expanding in India including Berkshire Hathaway, Hines, and many others. This is a good sign for Indian real estate market. It builds more trust between the real estate owners and the market in general, and particularly for the NRI segment.

Mohali is one of the hot destinations for property investment by the NRIs, and the area around Mohali Airport Road and in Mohali Aerocity can particularly benefit by these international real estate capital flow trends.

No Comments

Leave a comment Cancel