This post is taken from Knight Frank blog (source).

Governments have been keen to foster a REIT-friendly environment as it promotes a more liquid and healthy capital market, allowing developers to unlock value hidden behind each real estate holding, while giving investors a greater range of investment vehicles for risk diversification.

Many developing markets such as the Philippines, India, Thailand, and Indonesia are the proverbial fertile ground, where REITs listings on the public markets have been legalised and there is available stock under developers’ holds.

The Indian REIT market was established in 2019, and the government is now taking strides to open up regulatory strangleholds to improve liquidity, transparency and governance. In turn, the fruits of its labour are being felt, with major international players such as Blackstone and Brookfield sponsoring REITs in India, and more REITs are forecasted to be listed in 2021 and beyond.

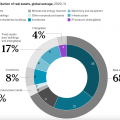

According to a research by APREA, the total market capitalisation of REITs in APAC will hit more than US$1 trillion by the end of the decade. This presents exciting opportunities for domestic developers, international investors, and potential sponsors as they look to bring their products to the Asia-Pacific markets for their next rounds of capital raising.

No Comments

Leave a comment Cancel